Are you noticing an increase in your auto and home insurance rates? If so, you’re not alone! Many people are facing higher premiums due to several factors, including inflation, population, property costs, and more. Aside from these factors, insurance premiums are also influenced by location, driving record, age, and credit score. Understanding these contributors can help you understand why insurance premiums are increasing.

For example, if you live in an area prone to natural disasters or other catastrophe losses, you may see higher premiums due to the increased risk. Similarly, a poor driving record with multiple accidents or traffic violations can lead to higher auto insurance premiums.

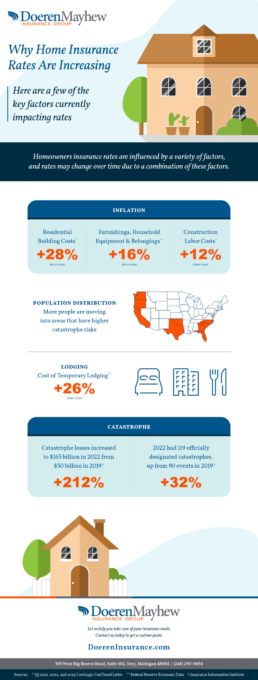

Key Factors Increasing Home Insurance Rates

Inflation

- Residential building costs*

- Furnishings, household equipment, and belongings**

- Construction labor costs*

Lodging

- Cost of temporary lodging**

Catastrophes

- More people are moving into areas that have higher catastrophe risks, including California, Texas, and Florida

- Catastrophe losses increased to $165 billion in 2022 from $50 billion in 2019†

- 2022 had 119 officially designated catastrophes compared to 90 events in 2019†

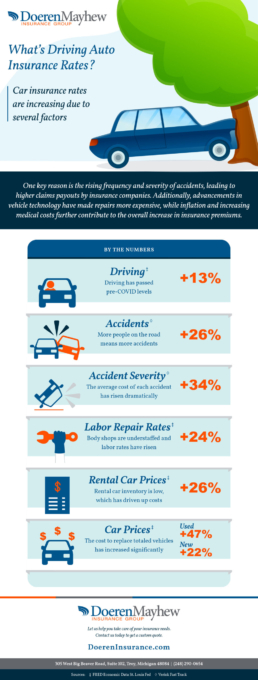

Key Factors Increasing Car Insurance Rates

Driving ‡

- Driving has passed pre-COVID levels

Accidents ♢

- Frequency and severity of accidents is increasing

- Increasing medical costs

Repairs ‡

- Labor repair rates have risen and body shops are understaffed

Rental Cars ‡

- Rental car inventory is low, which has driven up costs

Car Prices ‡

- New and used vehicle prices have increased significantly

- Advancements in vehicle technology

How to Lower Your Home & Auto Insurance Premiums

Thankfully, there are several steps individuals can take to lower their insurance home and auto insurance premiums.

- Bundle policies together

- Inquire about policy discounts

- Raise your deductible

- Improve your home security

- Maintain a good credit record

If you’re concerned about rising insurance rates, it’s important that you consult a trusted insurance agent. At Doeren Mayhew Insurance Group, we work with our clients to ensure their coverage matches their unique needs. Contact us to get started finding the best home and auto coverage for you and your family.

Sources:

* Q3 2021, 2022, and 2023 CoreLogic CostTrend Letter

** Federal Reserve Economic Data

† Insurance Information Institute

‡ FRED Economic Data St. Louis Fed

♢ Verisk Fast Track